Subscribe

Sign in

Hacker Noon’s CEO on How to Raise $1M From Your Readers

Share On

"The truth: If you’re in digital publishing, you can’t truly own the digital experience without owning the software."

I didn’t intend to raise money for Hacker Noon. By 2018, I had founded and bootstrapped a profitable business for several years. However, unforeseen market conditions threatened our revenue steam and prompted us to think bigger.

The truth: If you’re in digital publishing, you can’t truly own the digital experience without owning the software. The catch-22 is: If your experience doesn’t have traction, you won’t have enough money to build your own software. So how do you logistically turn your readership into shareholders? Consider this your guide.

The Jobs Act (2015) made equity crowdfunding possible. The important distinction in this legislation is that unaccredited investors can buy stakes in private companies, in amounts that range anywhere from $100 to $107,000. Historically, only accredited investors had access to investing in private companies.

On the entrepreneur’s side of things, equity crowdfunding allows entrepreneurs to set their own terms, meaning a successful campaign comes down to executing a marketing and sales funnel. You have to be able to tell the story of your company’s past, the state of its present and how an increased budget could lead to increased returns in the future.

It’s important to note that equity crowdfunding is a great option for business with large dedicated communities. Think about it from the visitor’s perspective — when you’re browsing the web, how often do you have an opportunity to own a portion of the site you’re on? It’s a rare opportunity for your visitors to take a stake in your company’s success.

Here are the eight major milestones to running an equity crowdfunding campaign:

1. Choose a Platform.

We went with StartEngine, mainly because their CEO, Howard Marks, had been a contributing writer on Hacker Noon for a while. But also because their software is dope.

2. Decide on your Offering Type

We went with a Regulation CF raise with a maximum of $1.07M. Note: If you set the maximum at $107K, you can avoid most of the cost, time and labor of the next step (third party reviews). You can also do a Regulation A+ and raise up to $50M.

3. Conduct Third Party Legal Review and Third Party Accounting Review

This step is fairly time-consuming (it will take a month or two to complete) and will probably cost you between $10-20K. It’s a very thorough review of your business. You have to be prepared to open up the hood, have a super organized engine, and validate that it is, in fact, how the car is running.

4. Write Your Story

The platform you choose will generally offer help here, but 98% of this work was done by me and my COO (and wife) Linh Dao Smooke. It’s very hard to summarize and sell the past, present and future of your operation on one page. But there is a purity to putting it all down on that page. To do this part right, I’m recommend budgeting at least 100 labor hours from your team. Imagery matters. Social proof matters. Context matters. And it truly was a challenging, useful, and rewarding exercise in visualizing the future years of our company.

5. Marketing Your Offering

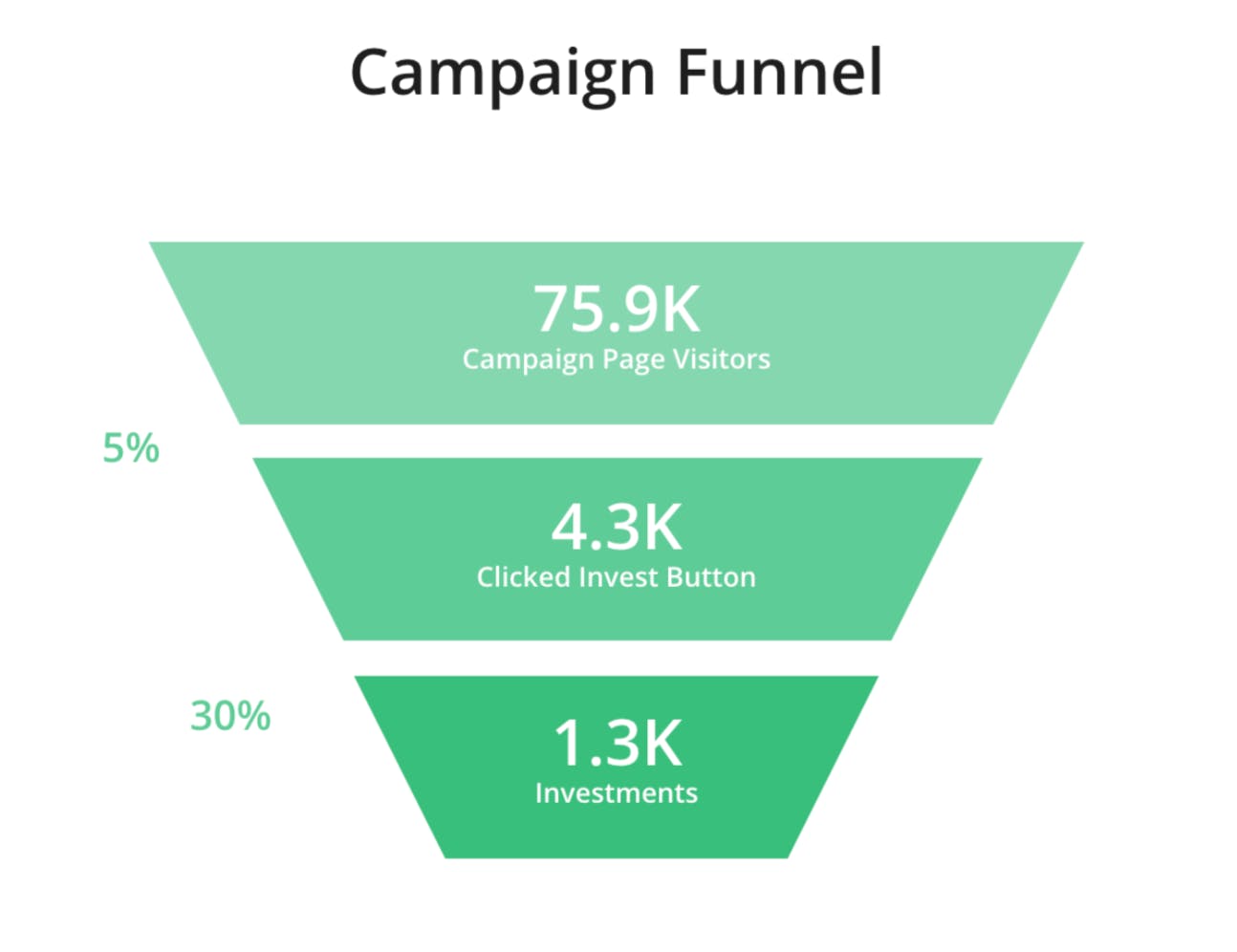

Our primary marketing strategy was extremely simple. We put a link to the offering at the top of our site, in addition to all our other marketing channels. Over the course of the campaign, we had ~75L visitors to the page and ~85% of those visitors came directly from Hacker Noon.com to StartEngine.com/hackernoon. Some people also buy ads, but we chose not to. I did do a couple speaking events at the University of Colorado to get the word out on the ground, but for the most part our goal was to simply convert people who were already believers into shareholders. A look at our campaign page funnel:

6. Sell Your Offering

A word to the wise: You should run an outbound sales campaign in conjunction with your offering. Larger investments will want that personal touch — either via email, video chat, or if you happen to be in the same city, through in-person meetings. They’ll want to hear more about what perks they’ll get in comparison to other levels of investments. We offered perks at the $1K, $3K, $10K, and $25K levels, and then at the maximum level of $107K.

If someone did invest $107K, our main "perk" was basically just a t-shirt. But for those who invested at the maximum level, we promised them that I would personally go to their city or place of business, work on their tech, work on their media and story and help them build whatever they were working on overall. We hoped that people considering investing $107K would do the same for us. At this level, we were really more looking for partners who wanted to spend time bettering Hacker Noon (don’t worry, they got a t-shirt too). Intilized Capital’s Garry Tan and Alexis Ohanian were the only people to buy those top-tier tees, and it was very fun to deliver those shirts in person.

7. Community Manage Your Offering

StartEngine provides a commenting section near the end of their campaign pages, and we had hundreds to respond to ours. It’s almost like the town hall discussion of the campaign. This is time-consuming, but we took the time to respond to these comments and tried our best to address any ideas, concerns, and questions readers had.

You’ll inevitably deal with a few trolls in this step of the process, but most of the comments are people who are debating whether or not to invest, and how much. You should also budget time for engaging in social media discussions. For us, that was mainly on Twitter and via private messages on LinkedIn. The frustrating thing is that timeliness really matters; so it’s hard to say how many hours to budget for this part. Just know that it disrupts your workday a lot, having to jump in and out of a lot of conversations. Additionally, equity crowdfunding is a new industry, so there were a lot of people who wanted to invest but couldn’t figure out how. StartEngine support helped a lot with this, but it still cost us a lot of time. Many readers clicked “invest” but couldn’t figure out (or didn’t want to) how to give up all the information required to make the investment. And we had another 50+ people who wanted to invest but were unable to because they lived in the UK and CA.

8. Continue to Run Your Business During The Campaign

This part is difficult. As they say, fundraising is a full-time job. The good news: As a startup founder, you’re generally used to doing three or four full-time jobs all the time, so in that way, it’s just chaos as usual.

I hope this helped you determine if (and if so, how) you should run an equity crowdfunding campaign. It’s empowering for entrepreneurs to set their own terms, and as someone that now has over 1,200 shareholders, I can tell you that there are dividends to having a large community of people with the same vested interest. My shareholders have introduced me to customers, provided feedback on our beta product, published on our site and much more. I’m very thankful and humbled that they took the time to learn about my business, and determine that it can grow.

Disclosure: this is not financial advice, just me passing a couple experiences and (bias) learnings.

David Smooke is the Founder/CEO of Hacker Noon, a tech publishing platform that shares ‘how hackers start their afternoons.’ In March, they raised ~$1M from ~1200 people to expand from publishing company to software company.

Comments (4)

KP@kartheekcsit

Good info to new Startups looking at Crowdfunding. Thanks for the writeup @DavidSmooke

Share

see here

I think Howard Marks has some good points. I’ve seen in my own experience that when you do content marketing well, it can pay off big time. His suggestion of hiring crypto cpa denver colorado truly inspired me to improve my productivity. I truly believe that he is one of the most insightful people in all of entrepreneurship, and his thinking on how to raise money from your readers is no exception.

Hacker Noon is a publication that publishes startup ideas from the community, and then helps make them happen. In return, they take a small slice of equity in the company. They call this crowdfunding but it’s really more like crowd-investing or crowd-allocating. I have got some beautiful pitch deck PowerPoint templates you should also try this as they are quite good. It’s not an ICO or token sale, because there’s no new cryptocurrency involved… it’s just investment via equity in your company.

More stories

Mathew Hardy · How To · 3 min read

How to Detect AI Content with Keystroke Tracking

Sanjana Friedman · Opinions · 9 min read

The Case for Supabase

Vaibhav Gupta · Opinions · 10 min read

3.5 Years, 12 Hard Pivots, Still Not Dead

Kyle Corbitt · How To · 5 min read

A Founder’s Guide to AI Fine-Tuning

Chris Bakke · How To · 6 min read

A Better Way to Get Your First 10 B2B Customers