This article originally appeared on the CommandBar blog.

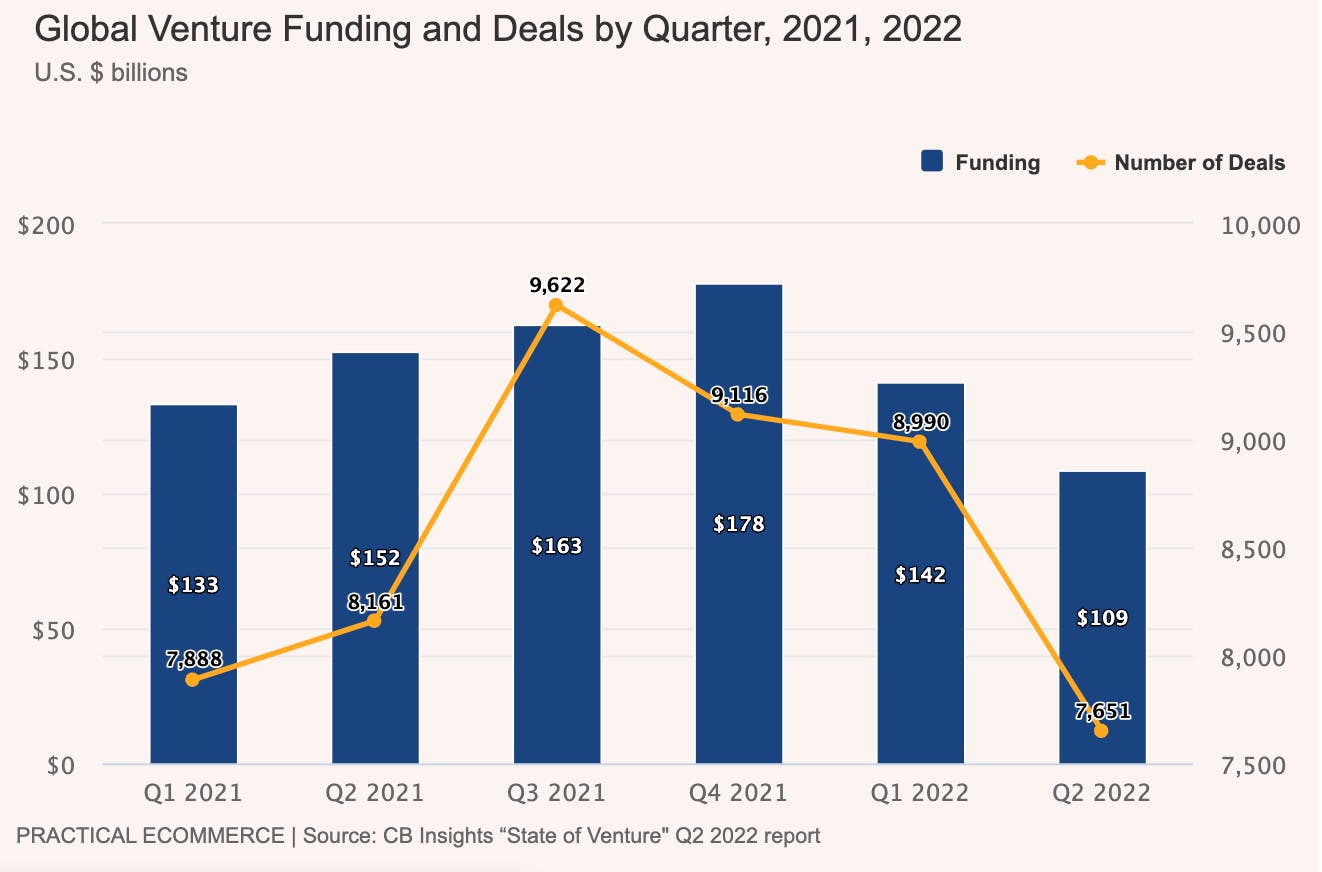

A recession makes it harder to secure fundraising to fuel your startup (or keep it warm during the winter). Q2 of this year saw $108.5B in global venture capital funding raised across 7,651 deals. That’s the largest quarterly percentage decline in deals (and the second-highest decline in funding) in a decade, though admittedly 2021 was the headiest year on record.

Source: CB Insights

For startups, this means one of two things: scramble to become profitable and gain traction or get creative about fundraising. Kudos if you can manage both.

If you want to get creative, what are some non-traditional but recession-proof sources of funding?

Unlikely investors

As risky as it is, venture investing has attracted people from all walks of life who have the means to bet on technology and innovation.

Being an investor no longer means you need to work at a venture capital fund or even work in technology (or the field you're investing in).

Instead, we’re seeing more and more artists, influencers, and Hollywood household names put their investor caps on. The Chainsmokers, Serena Williams, Ashton Kutcher, Nas, and Priyanka Chopra are a few familiar names you might now find on a cap table.

The Chainsmokers closed their debut venture fund, Mantis, with $35 million

Natalie Portman has made several startup investments in recent years, including Oatly, Bowery Farming, and Maven Clinic. Both Williams and Chopra invested in dating app Bumble. Celebrities like Kerry Washington, Alex Rodriguez, and the Chainsmokers have actually built their own venture firms entirely dedicated to startup funding.

Some have seen great success. Ashton Kutcher’s Sound Ventures invested in companies like Airbnb, Uber, and Acorn. Also gaining popularity are investment groups like Constellation Capital. The boutique venture firm includes not only angel investors and family offices but also 16 limited partners consisting of actors, professional athletes, and influencers. Among the LPs are Sofia Vergara, Hollywood actress, and Ndamukong Suh, NFL player for Tampa Bay Buccaneers. Suh is so into his investing side gig that it shows up first in his Twitter bio, before his day job.

Some hip-hop and rap artists not only invest, but sing about it too, like Jay Z’s cap table entendre in “God Did.” According to Crunchbase, Kendrick Lamar made his first angel investment just last year, while The Weeknd already has 7+ early-stage startups in his portfolio since his first check in 2019, including Backbone, a gaming company that recently raised a $40 million Series A. The same startup has got support from YouTuber Mr. Beast (Jimmy Donaldson), who tapped his 100M+ subscriber base to promote their product, boosting their follower count by a quarter of a million.

Getting famous names as investors pairs really well with party rounds, too. If you’re unfamiliar with the concept, party rounds are financing rounds usually found among early-stage companies. Instead of raising large amounts of money from a few investors, founders choose to raise smaller amounts of money from many investors. This also means no single investor leads the round. You’ve likely seen some around. They sometimes announce themselves through graphics that might remind you of the Coachella line-up.

Some critics argue that having a lot of investors in a round and no lead signals a lack of skin in the game—meaning that no investor is committed enough to care about the company as a lead would. While others might prefer VCs or angel investors to keep their distance. But right now, such nuance might be the least of your worries. Capital is capital, after all.

What’s really interesting about party rounds is that it allows founders to pull in big names that aren’t always linked to VC funds. As mentioned with the unlikely investor examples, big names on a cap table don’t mean just more capital but more extensive networks and more avenues for distribution, too.

Popular party rounds

Mercury is a great example. The neobank announced a $20M Series A in 2019, which CRV led. Seed-round lead, a16z, also joined in, as did 38 other investors. Combined with its seed round, it puts its total number of investors at around 100. Names include folks you’d expect, like 500 Fintech and angels such as Ryan Petersen (CEO, Flexport), Rahul Vohra (founder, Superhuman), Anjula Acharia (angel investor), Larry Fitzgerald (angel investor), and Suhail Doshi (co-founder, Mixpanel). But what might surprise you is participation from names like Will Smith, Nick Jonas & Phil McIntyre, and Serena Williams.

Front, the collaborative inbox for companies, raised a $59M Series C back in 2020 without a VC lead investor. Instead, it raised funds from enterprise CEOs and execs at Atlassian, Zoom, and Okta.

In a blog post, co-founder and CEO Mathilde Collin shares the motivation behind raising from operators: “[It] wasn’t something I had planned. It happened that 2 of them showed interest, offering to invest larger sums than I would have thought. Bryan Schreier, partner at Sequoia and member of Front’s board, then suggested that we structure the round that way. I turned the idea into a deliberate strategy and reached out to a few more people.”

AbstractOps even wrote a playbook for raising a party round. The company raised $7,654,321 from “VC Investors, Solo Capitalists / Super Angels, Founders / CXOs at 20+ unicorns, and another 300+ startup operators and angels.”

Founders and syndicates

Hollywood stars are not the only ones dipping their toes into the startup investing world.

Investment platforms like AngelList’s Venture have made supporting private companies more accessible. And AngelList Stack makes it easy to manage all of your investors (traditional and non-traditional). Recent SEC regulations also allow people to become accredited investors without having to be part of the Two Comma Club. Among these, founders, operators, and tech enthusiasts tend to be the most excited.

Front’s party round is a great example of raising money from founders who aren’t necessarily seasoned investors or have millions to drop but believe in the company’s mission and are users of the product. What makes Front’s fundraise interesting is the network that made it possible: Y Combinator. Although batches only last three months, the benefits companies get go far beyond that. YC has fostered a culture focused on alumni investing in companies joining subsequent batches, especially through its Alumni Demo Day. The event happens prior to the traditional Demo Day for investors, making it easier for alumni to get early access to promising startups.

Another way we’re seeing founders raise capital and angels invest is through syndicates. In short, they’re an investment vehicle that allows a group of individual investors to pool their funds and invest in a single company.

For founders, the clear advantage is that they don’t have to deal with a large number of investors individually, which can be problematic in terms of cap table management and tax documentation. Instead, syndicates use a lead investor to manage the process in exchange for a carry.

SPVs (“Special Purpose Vehicles”) are also great from the individual investor’s point of view. They don’t have to manage any entities or work with lawyers on drafting complicated terms.

Initiatives like Hustle Fund’s Angel Squad are working on demystifying venture capital for those seeking to get into it. The team behind it teaches its members how to invest, regardless of their level of experience. “Sure we have execs from all of the biggest tech companies, startup founders who have sold their company for billions, and experienced investors. But we also have art curators in LA and NY, a chef in Turkey, a pilot in Australia, lawyers, doctors, allergists, real estate investors, quant traders, and more,” they share.

Equity crowdfunding

For many late-stage companies, the current landscape has meant slashing valuations through down rounds to raise more capital. Others are using crowdfunding (also known as a “community round”) to ride out the storm.

Replit, the company we highlighted for its distinctive Series B announcement, raised a subsequent $5,240,140 community round using Wefunder. Gumroad did the same thing back in 2021, using Republic.

Recent changes by the SEC (Reg CF) upped the amount startups can raise from a total of $1.07 million to $5 million within a 12-month period. Crowdfunding is an interesting experiment in modern capitalism as it shifts the pressure of growing unsustainably after raising VC funds to an alternative model in which early adopters get an upside.

You also can’t say community in 2022 without at least hinting at Web3. DAOs (decentralized autonomous organizations) also play a role in how crowdfunding is evolving. Because of their censorship-proof nature, DAOs can lift geographical restrictions, allowing anyone to raise or invest capital. The same applies to the $5 million limit the US imposes on startups using crowdfunding, which is non-existent with DAOs.

While still in its infancy, 2021 saw an ambitious group of constitution-loving crypto believers raise more than $47 million in Ether to purchase an original copy of the US constitution. However, its failure to win the auction highlighted an important (and risky) trait of DAOs: they have minimal regulations from authorities. This means that if an illegitimate startup were to raise funds through a DAO, backers likely wouldn’t be able to get their money back.

Raad Ahmed and the team at Lawtrades raised $6M at an $80M valuation by combining some of these methods. They ended up with a mixture of private individuals, including their own customers, operators from Facebook, Uber, Netflix, Robinhood, and one VC - managing it all with an AngelList RUV. What's more, they did it with almost no pitch meetings, having shared their deck with folks on Discord, and doing a demo day on Stonks.

Looking to the future

While forecasts don’t look too rosy, it’s not all doom and gloom. Early-stage rounds tend to be less impacted by the changing environment, as investors don’t have the same level of expectations around revenue and traction as they would with more mature companies.

Plus, with so many funding options and a wider investor pool available to founders, there’s a great deal of potential to get creative and grab that dry powder.